Relapse

The Five Stages of (Financial) Change

You may be making more progress than you know.

Posted August 31, 2017

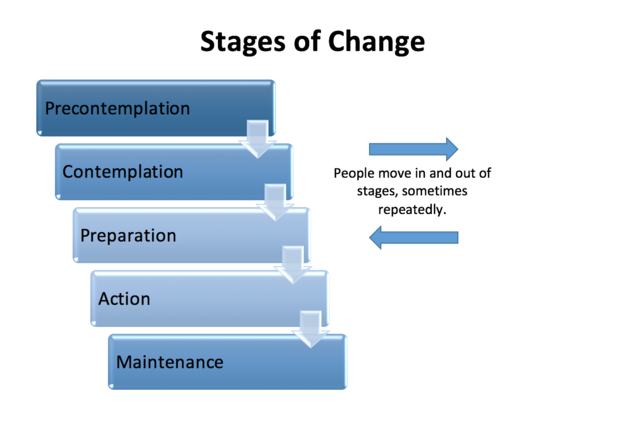

Change isn’t easy, especially when it involves breaking habits. Anyone who has ever made a New Year’s resolution knows this all too well. What you may not know is that, according to research on change, there are five distinct stages that we go through on the way to a new habit, and actually making change doesn’t happen until stage 4.

You may be moving down the path of change without your even knowing it. So, here I will lay out the five stages so that you can give yourself proper credit for your current progress, and stay motivated to keep on going.

The Transtheoretical Model of Change (TTM)

The psychology of addiction has long intrigued scientists who work in areas of behavior change. Addictive behaviors involve biology, psychology, and society, and each one of these areas employs a host of researchers who want to understand how to better help people break the chains of habits that are destructive to the body and mind. As a result, there are thousands of studies in print across many scientific fields that attempt to solve the problem of behavior change from the vantage point of that particular discipline. The TTM, or Stages of Change model is defined as a ‘biopsychosocial’ framework because it conceptualizes the process of change in a way that includes many fields of research, thus the name ‘transtheoretical.’

The researchers that posited the TTM (Prochaska & DiClemente, 1983; Prochaska, DiClemente, & Norcross, 1992) looked at studies that examined both self-facilitated and professionally supported recovery from addictive behaviors, and saw that people progressed through five distinct stages before the change was made permanent.

Now, you and I may not be addicted to overspending, debt, or disorganization, but if this model helps us understand how chainsmokers and heroin addicts recover, it can surely help those of us who have some changes to make with our money.

Stage 1 - Precontemplation

Also known as denial. Quite literally, precontemplation means ‘before thinking.’ This stage represents a time when change may be needed, but the person is not ready. For example, if you know that you probably need an emergency fund, but you have no serious plans to start saving more in the next six months, you may be in the precontemplation stage.

Stage 2 – Contemplation

You could call this stage, ‘Thinking about it.’ This is when you know that you probably should make a change, but you’re not ready to act just yet. At this point, you have become conscious of the need, or maybe you have begun to think, ‘you know, I should probably get better at …’ but no actual change has taken place. At this point, you probably feel ambivalent about making a change. Yes, it would be nice to have more in savings, but it’s also nice to be free with your cash. You haven’t changed yet, but you’re thinking about it.

This is progress! Going from precontemplation to contemplation is a big step, but we often belittle how much growth it represents because there is still no actual change. Don’t let a lack of results get you down, because you are moving forward. If you are at the point where you have recognized an area of your financial life that you might want to change, then celebrate that growth! The first step forward is bringing that thought into your consciousness.

Stage 3 – Preparation

Half way through, and still no changes have been made. You’re ready now, though. You’ve decided that it’s time. You’re going to try to save (or cut up those cards, or get more organized, or finally learn about investment), and you’re gearing up to take the plunge. In the health world, this might manifest as buying a gym membership, researching how to quit smoking, or figuring out which foods you might substitute for your favorite burger/fries combo.

Financially, this might look like setting up a specific place to put all your bills as soon as they come in, uploading all of your accounts to budgeting app, or thinking about what else you can do to unwind instead of your weekly shopping spree. This is the stage when things get moving. You may have tried and failed a few times in the past, but you’re warming up. You’re moving forward. You’re setting the stage to really make it stick.

In the preparation stage, it is important to understand your triggers. Are there certain places, people, events, or moods that tempt you toward this particular habit? This is the time to make a plan for how you will react differently when faced with that trigger. If mental exhaustion keeps you from organizing your bills and due dates, can you set aside a time when you are fresh to set up automated payments? If you overspend when you’re out with the girls, can you arm yourself with a mental picture of your dream home to help you remember your real goals before you go out?

Stage 4 – Action

As I said, it isn’t until stage four that we actually start to change our behavior. This is when you start to actually do something different than you have done before. You transfer money from your paycheck to your savings account instead of putting it all into checking. You start to open all your bills as soon as they come in. You check your budget regularly to make sure you are on track. This is the stage we all recognize because it looks like progress, and so this is the only stage we really give ourselves credit for. It’s important to understand that all of the steps leading up to this are critical to success. If we make a change without really thinking it through, without preparing our life and mind and environment to support that change, we often fall into the dreaded state of relapse.

Relapse is not a distinct stage in the TTM, though some psychologists include it in their models because it is so common. Personally, I like to think of it as a part of the action stage. If you have decided to limit your spending when you are out with friends, but on a particular night you blow your budget and wake up with buyer’s remorse, this doesn’t mean you have failed completely. You can take the experience as a lesson in regret, and use that energy to push yourself forward with more determination next time you are in the same situation. Go back to the feelings that triggered you. How can you address them better next time? Action is not a once-and-for-all effort. It takes practice, failure, determination, and grit to keep on going, but if you have done the work leading up to it, you can make change last.

Stage 5 – Maintenance

Otherwise known as your new normal. Action is hard. Maintenance is easier. This is the stage when your new behavior has become routine. You no longer need to think ahead about what might trigger you at the mall, or keep your credit cards in a lockbox at home because you can’t trust yourself. In this stage, you still have to be conscious about maintaining your new rhythms and patterns, but you are in less danger of relapse.

The popular myth is that it takes 12 weeks to start a new habit. Unfortunately, there is no real timeline. Depending on how deeply ingrained, how emotionally charged, and how central to your identity the behavior you are trying to change is, it may be much shorter or longer before you reach this stage. Patience is key. You might remain in stage 4 for years before you reach this milestone, but once you do, all that effort pays off. This stage represents your new life, where saving (or investing, or living debt free) has become the norm, and when you do face temptation, you have all the tools ready to kick it to the curb.

Gimmicks and quick fixes sell the hope that we can change overnight, but real and lasting change can take years. This is as true for our financial habits as it is for our health. Each step along this path represents growth, progress, and a reason to be proud, so own that stage and keep moving forward. Delays, mental planning, trial and relapse – these are all milestones on the way to the new you.

Too often, I hear people talk about their bad financial habits as if they were as unchangeable as the day they were born. Maybe we think that way because we assume that changing financial behaviors should be easier than changing our diet or our exercise routine, but for most of us, that is simply not true. This does not mean you are weak-willed, unmotivated, or simply wired to be bad with money. Don’t buy that tripe. It takes time, effort, and an understanding of the road ahead to get where we want to go. It is my sincere hope that knowing the stages that you can expect to pass through can empower you to keep going, no matter where you are now on the road to financial freedom.

References

Prochaska, J. O., DiClemente, C. C., & Norcross, J. C. (1992). In search of how people change: Applications to addictive behaviors. American Psychologist, 47(9), 1102-1114.