Gender

How Should Market Researchers Ask About Gender In Surveys?

New gender identity research shows we need to rethink the answer.

Posted September 4, 2016

Over the past decade, I have designed, commissioned, and analyzed dozens of market research surveys. They have varied on virtually every dimension. Some were short with a handful of questions. Others were long, taking half an hour or more to complete. Participants provided their answers using pencil-and-paper, over the telephone, in person, and more recently, online or with mobile apps. The surveys differed in questions asked, samples targeted, and incentives offered.

Why do we need more than two gender categories?

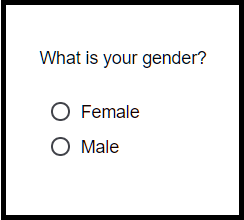

But they all had one thing in common: how I elicited the participant’s gender. In virtually every case, I gave participants two options to choose from, male or female (see adjacent figure). In a handful of instances, I might have provided a third category, “Prefer not to say”. (I also confused gender with sex, which distinguishes between people based on biological differences, but that is a topic for another day).

Recent social science research, and the rising consciousness of gender equality as a social issue highlighted by movements around the world indicate that a dualistic way of categorizing gender as male and female in market research is outdated. It’s not just ethically wrong, but even practically speaking, it is incorrect and a bad practice.

Transgender is a third important gender category

Looking beyond male and female gender identities, transgender individuals represent a significant number of the population. One June 2016 study conducted by researchers at the Williams Institute used CDC’s Behavioral Risk Factor Surveillance System data and estimated that 0.6% of all US adults, or about 1.4 million people, identify as transgender. This means in a typical market research survey of 500 participants, we would expect to find around 3 transgender respondents. In some specific location-based samples, the numbers are even higher (For example, the District of Columbia had a transgender identity rate of 2.8%).

Another study conducted by psychologists Kristina Olson, Aidan Key, and Nicholas Eaton found that “transgender children are not confused, delayed, showing gender-atypical responding, pretending, or oppositional — they instead show responses entirely typical and expected for children with their gender identity.” They concluded: “The data reported in this paper should serve as further evidence that transgender children do indeed exist and that this identity is a deeply held one.”

And finally, there are important practical reasons for measuring transgender identity directly. Social work researcher Taylor Cruz found that transgender and gender non-conforming Americans receive poorer medical care, partly because many large surveys failed to gather accurate data by masking differences between different consumer groups. Numerous studies show that transgender individuals are stigmatized and discriminated against. So it seems to me that not acknowledging and measuring transgender identity explicitly in a market research survey is yet another form of discrimination against transgender individuals.

Beyond the transgender category

It is clear we need to add a transgender category to the gender question in market research surveys. But should we consider other gender categories as well? At the moment, New York City recognizes a total of 31 gender identities. They include categories like agender, androgyne, bi-gender, gender fluid, and genderqueer. Along similar lines, Facebook introduced 58 options to specify gender in 2014 and gave its users the option to select a preferred pronoun to address them. Some psychology researchers, too, have argued for the inclusion of categories like intersex and genderqueer, but cautioned that the terms and definitions are still evolving. And survey designers are starting to add some of these categories to their surveys as well.

As of now, the views of experts on how many non-overlapping gender categories exist, whether an exhaustive list can be created, what each one exactly means, and whether gender non-conforming individuals can reliably classify themselves into one of these categories are still in flux. It seems to me that we are not still ready to provide an accurate list of gender identity categories to survey respondents to choose from.

My recommended question to elicit gender in market research surveys

The state of the art advice on the question of how to elicit gender in surveys comes from a September 2014 report compiled by the Williams Institute titled “Best practices for asking questions to identify transgender and other gender minority respondents on population-based surveys.” It suggests using a two-step approach for surveys that are targeted toward transgender and other gender minority participants.

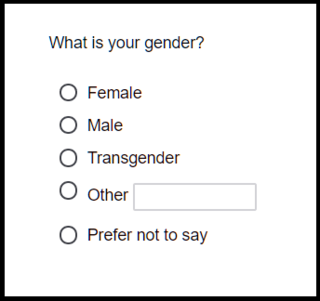

For broader user in market research surveys where gender may not necessarily be the study’s focus, I adapted their recommendation. I have designed the question in the adjacent figure that I have started to use in my surveys to elicit gender. My suggested question adds the transgender category as a third choice and a fourth category allowing respondents to write-in their gender. This approach is similar to Facebook’s option of a “Custom” gender box to be filled in by the user. And of course, the fifth and last option is a “Prefer not to say” for those respondents who may not want to reveal their gender to the market researcher.

Conclusion

Any well-designed market research survey is based on two core principles: the principle of accuracy and the principle of inclusiveness. A questionnaire should be designed to gather information accurately, using best practices of survey design that psychometricians have formulated over several decades. But this is not enough. A survey should also be inclusive. When a respondent has finished taking a survey, they should feel like the opinion they have provided will be valued just as much as every other survey-taker.

Business as usual, by asking the “What’s your gender?” question and providing only the “male” and “female” options to choose from violates both principles. It is an implicit endorsement of discrimination against transgender and gender non-conforming respondents. And in some cases, the analysis may end up masking differences between respondent groups (because gender was not elicited correctly). Using a five-category question to provide gender that allows respondents to choose from male, female, transgender, and other, categories, and the freedom to write-in a custom response if other is chosen, will increase both accuracy and inclusiveness of market research surveys.

Acknowledgment

I would like to thank Eric Gould Bear for bringing this question to my attention and for an interesting conversation on this topic.

About Me

I teach marketing and pricing to MBA students at Rice University. You can find more information about me on my website or follow me on LinkedIn, Facebook, or Twitter @ud.