There are many common investment decisions that hinder wealth building. Many investors lack diversification in their portfolios, and therefore take more risk than necessary for their earned return. Other investors trade too much and lose money from commissions, bid/ask spreads, and emotional biases that are enhanced. This bias is often called ‘overconfidence.’ A third common behavior is called the disposition effect. Here, investors are too quick to sell winner positions and tend to hold losers too long.Investors also suffer from the home bias (investing too close to home), and they chase high returns.

Not everyone makes these mistakes. What causes some people to trade overconfidently while others do not?

Two financial economists examine this question, Henrik Cronqvist and Stephan Siegal. They want to determine the role that genetics plays in investment biases. Their analysis is clever. They use the Swedish Twin Registry of over 30,000 people and data on their investment behaviors. Note that identical twins share 100% of their genes, while fraternal twins share only half.

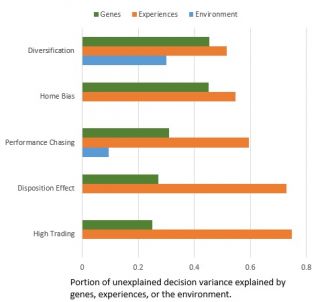

Investment biases may be due to a person’s socioeconomic characteristics, like age, gender, education, wealth, etc. In addition, decisions could be influenced by genes, common environmental factors (like growing up in the same house), or individual specific experiences. After accounting for socioeconomic factors, the professors determine the portion of unexplained investment decision variance in an investment bias from genes, environment, and experiences.

They find that the socioeconomic characteristics explain very little. For the diversification decision, socioeconomics explain only 13%, while they explain on 1% for the home bias. The unexplained variance found is shown in the graph.

Note that genes seem to explain up to 45% of the decision biases in diversification and home bias. Genes explain 30%, 27%, and 25%, of the performance chasing, disposition effect, and overconfidence, respectively.

The common environment explains very little.

An individual’s experiences explain most of the investment decisions.

Thus, most of the investment decisions made are explained by both inherited genetics and individual experiences. However, it is surprising how much genetics plays a role. So choose your parents wisely!

Source: Henrik Cronqvist and Stephan Siegel, 2014, “The genetics of investment biases,” Journal of Financial Economics 113, 215-234.