Media

3 Surprising Reasons You Are Broke

1 in 3 American workers lives paycheck-to-paycheck. Here’s why.

Posted March 3, 2020

Do you find it hard to stretch your paycheck to the end of each month? If so, you’re not alone. A recent 2020 survey found that 32 percent of American workers run out of money before their next paycheck.

Given the rising cost of living, stagnant wages, and the ever-expanding wealth gap, this may not seem surprising. But here’s something that is—the percentage of people living paycheck-to-paycheck remained relatively the same regardless of actual salary.

For workers in the lowest salary category (making less than $15,000 annually), 40 percent reported living paycheck-to-paycheck. No surprise there. But nearly the same percentage of workers (32 percent) at the highest salary (making over $200,000 annually) also reported running out of money by the end of the month.

The results of this survey point to a surprising truth. Being broke may have less to do with what’s in your bank account and more to do with what’s between your ears.

Let’s explore three psychological reasons why you may be living paycheck-to-paycheck regardless of your income:

1. You Overestimate How Smart You Are About Money

On a scale of 1 (poor) to 6 (excellent), how would you rate your financial literacy skills?

Now let’s put that estimate to the test. Below is a brief financial literacy quiz. Answer the questions without Googling the answers or using a calculator.

1. Suppose you have $100 in a savings account earning 2 percent interest a year. After five years, how much would you have?

a. More than $102

b. Less than $102

c. Exactly $102

2. Imagine that the interest rate on your savings account is 1 percent a year and inflation is 2 percent a year. After one year, would the money in the account buy more than it does today, exactly the same or less than today?

a. More

b. Same

c. Less

3. If interest rates rise, what will typically happen to bond prices? Rise, fall, stay the same, or is there no relationship?

a. Rise

b. Fall

c. Stay Same

d. No relationship

4. A 15-year mortgage typically requires higher monthly payments than a 30-year mortgage but the total interest over the life of the loan will be less.

a. True

b. False

5. Buying a single company's stock usually provides a safer return than a stock mutual fund.

a. True

b. False

6. Suppose you owe $1,000 on a loan and the interest rate you are charged is 20% per year compounded annually. If you didn't pay anything off, at this interest rate, how many years would it take for the amount you owe to double?

a. Less than 2 years

b. 2-4 years

c. 5-9 years

d. 10+ years

Now add up your score, giving yourself a point for each correct response: 1=A, 2=C, 3=B, 4=A, 5=B, 6=B.

When people are asked to rate their own financial literacy, 71 percent give themselves a high score (that’s up from 67 percent 10 years ago). But when it comes to actual financial knowledge, the pattern is reversed. Only about a third of respondents get most of these quiz questions right. This tells us a large percentage of people overestimate how financially savvy they are (and there’s a good chance you are one of them).

According to the Dunning-Kruger Effect, people who know the least about something (in this case money) are the most likely to overestimate their knowledge. Or to put it bluntly, the dumbest people are too dumb to recognize how dumb they really are. So even if you think you are financially savvy, there’s a good chance you aren’t.

To make matters worse, financial literacy has been steadily decreasing over the last decade, with millennials showing the sharpest decline. In 2009, 30 percent of people aged 18-34 answered most of these quiz items correctly. In 2018, that number dropped to 17 percent. For those aged 55+, the number only dropped from 51 percent to 48 percent (for a complete breakdown of performance for each item by age group, check out this graph).

To reverse this concerning pattern, 19 states now have a financial literacy requirement in their public schools and more states are considering this move. And you can improve your own financial literacy by reading articles like this and following bloggers and YouTubers like Mr. Money Mustache, Two Cents, and Stephan Graham.

2. You Have No Idea Where Your Money Goes

When people have financial troubles, their first instinct is to seek out ways to make more money. Sure, you could ask for a raise or get a side hustle, but keep in mind that any extra money you make you’ll have to pay taxes on. So in reality, for every $1 you save, you would have to make around $1.50 to have the same financial impact post-taxes. This means that in most cases, cutting back on your spending is a better approach than trying to make more money.

But in order to trim your expenses, you have to know where your money is going. That means you need to record every penny you spend and try to stick to a monthly budget. It is a simple strategy—one you’ve surely heard recommended a thousand times—and yet most people don’t do it. For instance, in the recent survey mentioned earlier, two-thirds of the workers didn’t use a budget.

Behavioral change cannot occur if you don’t know what your baseline behaviors are. Psychologists call this the “test” phase in the TOTE (or Test-Operate-Test-Exit) model. Simply put, this model says that in order to effectively change any behavior, you need to know where you currently stand (Test), enact some sort of behavioral change (Operate), then check to see if the change was effective (Test again). If you achieve your goal by the second test, then you exit the system. If you don’t, you repeatedly circle back to test-operate until you achieve your goal or give up (either way, you Exit the system).

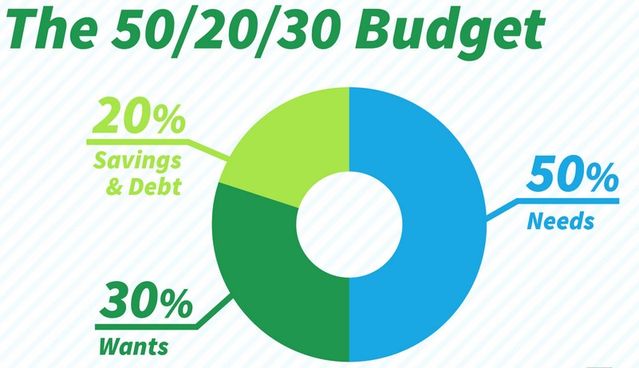

So let’s say you want to save $100 each month. You first need to Test by recording all the money that comes in and out of your accounts each month. Make it easy by grouping your expenses into three categories: Needs, Wants, and Savings/Debt. Experts recommend your spending in each of these categories should look something like this:

If it doesn’t, you need to adjust. That’s where the Operate comes in. Do you really need to spend $7 a day on coffee when you could make it at home? Do you really need to blow $15 on lunch when you could brown bag it? And how about that monthly gym membership you never use? Chances are there are several small tweaks you could make to free up a few dollars a day, which will easily add up to $100 a month. But such tweaks are impossible if you don’t actually know where your money is going.

3. You Are Influenced by Influencers

Millennials have had to contend with a financial pressure that none of their predecessors had: social media. When we see those beautiful people living their beautiful lives on Instagram, we are compelled to compare our lives to theirs. And doing so often leaves us feeling like we are falling short.

One survey found 90 percent of millennial respondents said social media compelled them to compare their own wealth/lifestyle to their peers (71 percent of Gen Xers and 54 percent of Boomers reported the same). And another survey found 57 percent of millennial respondents made unplanned purchases because of something they saw on social media.

Millennials aren’t the only generation to experience FOMO after the introduction of a new media source. Back in the day when TV was first introduced, it was rolled out regionally rather than nationally. That meant some communities were suddenly exposed to an idealized vision of what middle-class life looked like, whereas others weren’t.

The result was that those who got access to TV early suddenly felt depressed with their own current lifestyle, whereas those without TV did not. The first group suddenly felt like they were being deprived of things they needed or deserved, but this deprivation was “relative.” It wasn’t based on something concrete like their income level, but rather how their lifestyle compared to what they were seeing on TV. The same is happening now, with people consuming more social media feeling less satisfied with their current lifestyle.

One way to prevent lifestyle inflation and curb the influence of social media goes back to the above point about budgeting. When you feel the urge to buy something you’ve seen on social media, ask yourself if it is a need or a want. In most cases, it is a want that you can do without (and have been doing without all along).

Now if you ask this question and still feel you need to have the item, wait a day or two before buying it. Often if we wait, the intensity of our FOMO decreases, allowing cooler heads to prevail.

Lastly, remember that the images on Instagram are highly curated and, in truth, you have no idea what those people’s bank accounts really look like. Rather than trying to meet their lofty lifestyle, focus on getting the things that fit into your own personal values. Better yet, start following influencers who focus on living a frugal or minimal lifestyle or follow hashtags like #financialfreedom and #moneymotivation.