Aging

Does Spending a Lot Mean Someone Is Wealthy?

The belief that spending implies wealth could be influencing your finances.

Posted November 21, 2022 Reviewed by Devon Frye

Key points

- People differ in the extent to which they believe that spending money means someone is wealthy.

- Holding the belief that spending means you are wealthy can yield negative financial outcomes.

- Wealthy people tend to prioritize investing money and avoiding debt.

Imagine a woman named Susie. Susie goes out to eat at the best restaurants, stops at Starbucks to grab a fancy $7 latte on her way to work every morning (rain or shine), travels frequently, has a membership at a boutique gym, and is the first person in line at the Apple Store when the new iPhone comes out every year. If we don’t know Susie well, an outsider looking in could hold one of two beliefs about her personal finances.

The first belief is that Susie is wealthy and lives her life accordingly. After all, her lifestyle looks like one of luxury based on what we know about her. Susie has some expensive habits, to be sure, and big spenders must also be big earners—allowing her to also save for retirement and invest in addition to making discretionary purchases. Susie works hard and gets paid well for it, and she likes to enjoy the finer things in life while also living responsibly with her high income.

The second belief is that Susie is burning through all her money. With household debt in America soaring decade after decade, Susie may not be investing or saving her money at all, instead racking up thousands of dollars of debt on her credit card. As the authors of this research note, consumers have been described as being, “on an extended shopping spree” (Kappes, Gladstone & Hershfield 2021). Her lavish habits of spending on discretionary purchases might cause you to view Susie’s spending as financially irresponsible.

So I pose the question to you, which one of these two beliefs do you hold about Susie? And what if I told you that your belief about Susie could influence your own personal finances?

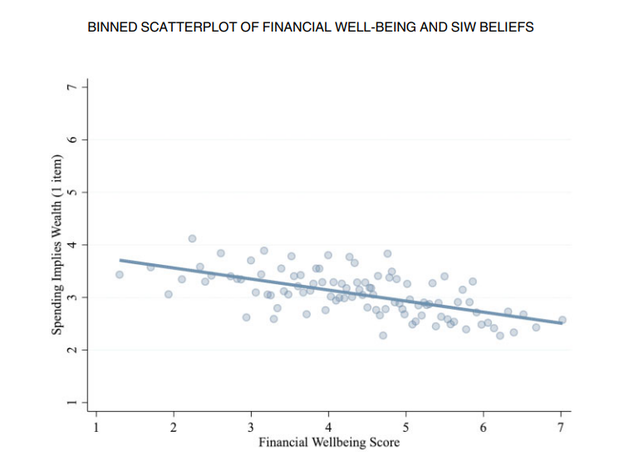

To understand how individuals differ in the extent that they believe that spending implies wealth (SIW), which maps on to the first belief about Susie described above, researchers gathered data from a personal finance app to look at how this belief influenced their financial well-being. The researchers found that those believing SIW had lower financial well-being, composed of more debt, less savings, and less money invested in the stock market (Kappes, Gladstone & Hershfield 2021). The graph below shows that as beliefs about SIW increase, financial well-being decrease.

Indeed, a study looking at the typical profile of millionaires finds that they tend to be big savers. Millionaires are more likely to max out their retirement accounts and prioritize paying off their mortgages and cars early to avoid debt and pesky interest payments on loans (Hogan 2019). That being said, a life of merely saving and investing makes for a dull life indeed. Spending money on experiences (Gilovich, Kumar & Jampol 2015), on other people (Dunn, Aknin & Norton 2008), and on treating yourself are all ways to increase your happiness and joy.

The next time you meet a person like Susie, know that just because someone spends big does not necessarily mean they are as well-off as you may think. The person driving a flashy new Tesla is not necessarily wealthier than the person driving a 15-year-old Honda, so don’t compare yourself. Focus on setting up your future self for financial success while also enjoying your life is a tried and true recipe for happiness and success, so enjoy the ride (even if it is in a 15-year-old Honda like mine).

References

Dunn, E. W., Aknin, L. B., & Norton, M. I. (2008). Spending money on others promotes happiness. Science, 319(5870), 1687-1688.

Gilovich, T., Kumar, A., & Jampol, L. (2015). A wonderful life: Experiential consumption and the pursuit of happiness. Journal of Consumer Psychology, 25(1), 152-165.

Hogan, C. (2019). Everyday Millionaires. Ramsey Press.

Kappes, H. B., Gladstone, J. J., & Hershfield, H. E. (2021). Beliefs about whether spending implies wealth. Journal of Consumer Research, 48(1), 1-21.