Aging

We are Retiring in Droves

Can New Public Debt Really Support Our Social Insurance Programs?

Posted September 3, 2014

The Baby Boomers are retiring and signing up for Social Security, Medicare, and Supplementary Medical Insurance (prescription drug coverage) benefits. I recently read that 10,000 people are retiring per day. That is over 3 million per year.

Our social insurance taxes stopped covering the costs of the benefits about five years ago. So now there is a deficit that will grow very large. There is a debate that seems concerned with how long the Trust Fund will last before it is depleted. However, I think that entire discussion misses the real issues. Unless new taxes are levied, that deficit will have to be funded with new issue of debt to the public.

Consider the Social Security Administration needing to cover a deficit to pay benefits. They hand over their special-issue treasury bonds to the U.S. Treasury for the cash. Of course, since the U.S. government runs a budget deficit, the Treasury doesn’t have the cash. So they issue new bonds to the public. So debt that is held within the government (called interagency debt) is converted to public debt and starts to impact the debt markets and interest rates.

What are the sizes of these new debt issues?

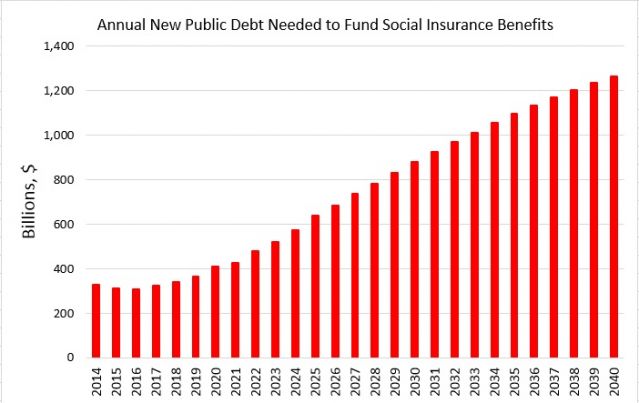

I began by obtaining the predicted general revenue shortfalls for Social Security, Medicare, and Supplementary Medical from the Social Security Administration. They come in percent of GDP. So, I take the 2013 GDP (about $16.7 trillion) and grow that into the future using a 2% real growth rate. Combining the shortfalls and the GDP estimates results in this graph.

In each of the next few years, the Treasury will need to issue over $300 billion per year. As a comparison, note that before the financial crisis exploded the national debt in 2008, the average new public debt for 2005-2007 was only $242 billion per year. So the social insurance deficit in the near term are more than the congressional budget deficits before the crisis. Notice that the number ramps up to $1 trillion 20 years from now. These estimates are in real terms (inflation removed), so the nominal numbers are likely to be higher.

I am 48 years old, so my retirement age is 67. That is about 20 years from now. In that twenty years, the Treasury will need to issue a cumulative $12.9 trillion to fund the social insurance deficit. As a comparison, the total public debt outstanding (July 2014) is $12.7 trillion. Wow, the public debt will double in 20 years just from the social insurance deficit. This does not include any other congressional budget deficits that need funding.

Can the public debt markets absorb that amount of new debt? Will it crowd out private debt issuances and thus harm the economy? What will it do to interest rates? Is this sustainable?